SPOILER ALERT!

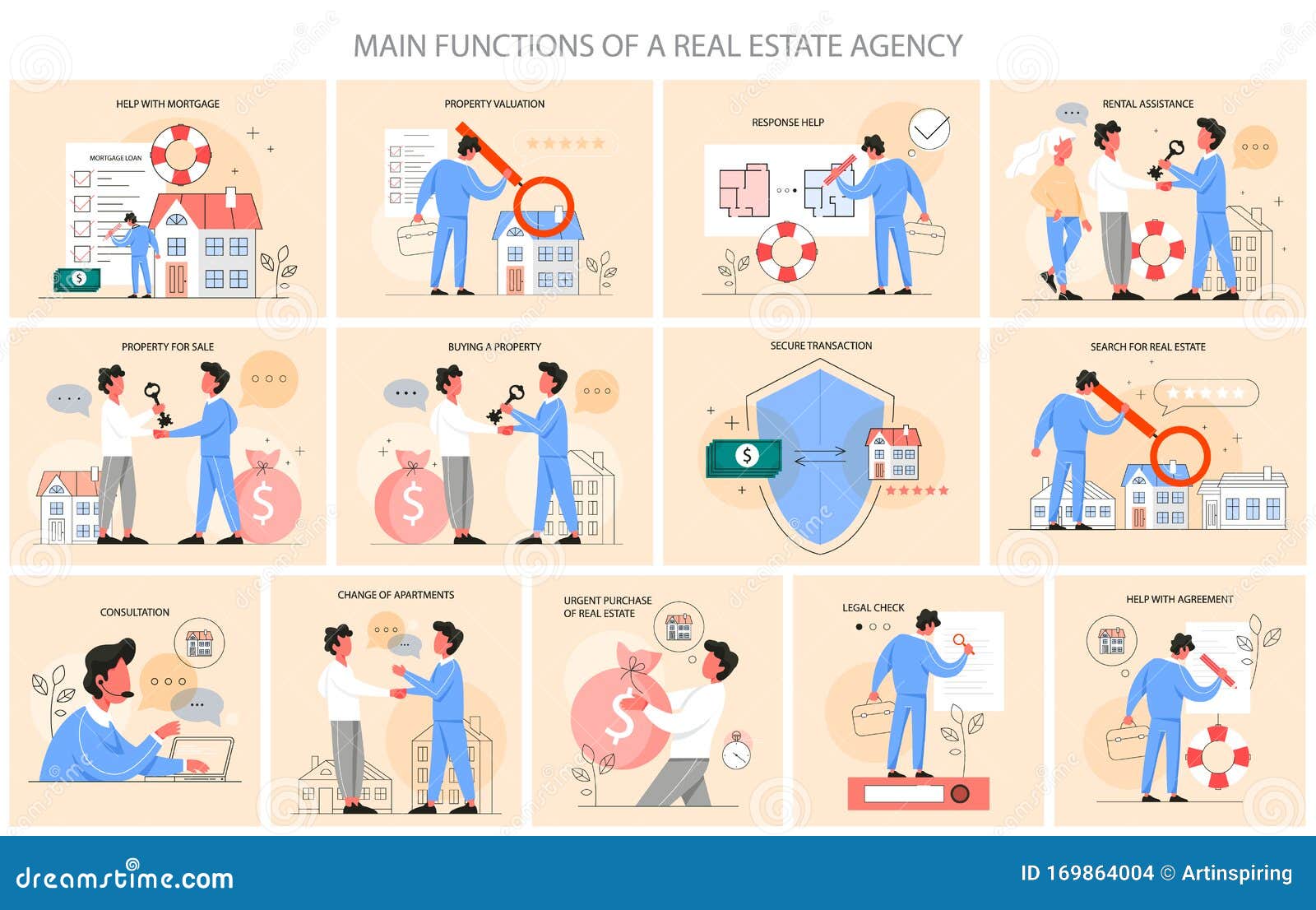

Your Real Estate Representative Will Have The Ability To Assist You Apply For A Home Loan

Authored by-Skovbjerg Pacheco

If you have finally found a home that you want to call your own, it's time to go ahead and make an offer. Buying a home is both exciting and scary; there are a lot of various options to consider. Getting help from experienced professionals is a wise move because they can provide some tips and ideas, which will benefit you.

Before looking at homes to buy, take stock of your current financial situation. Look at the level of your current debt, look at the stability of your income, and decide on the amount of house you can afford before you get your heart set on a home that is too expensive for your budget.

Prior to making any offer on a property, be sure to hire an inspector to look over every part of the home. Nothing is quite as disheartening as moving into a home and six months later finding out that the foundation is failing. Check the inspector's credentials, performance history and references before settling on one to inspect your investment.

When you are buying your first home there is an insurance called Private Mortgage Insurance. real estate agent in verrado protects the lender in case you don't make your loan payments. If you can, try to have a down payment of more than twenty percent to: avoid looking like a high risk, and having to carry that insurance.

To help you buy or sell real estate you have to find an agent that you can trust. Checking online reviews and talking to past clients is a great way to find out what others who have experienced working with the him or her have thought about the whole experience.

When buying a home, do not share the agent, inspector, or appraiser with the seller. There is a great chance that you will find yourself in a better position to buy if you find representatives that are on your team to help you get the best price on a home that is worth buying.

If you have a vague idea of how much house you can afford, start saving the money that you would have used for the monthly mortgage, and do not use this money for anything else. This will put the real affordability to the test. It is better to find out now rather than later if you can keep up with the house payments.

Take a look at how long you plan on staying in the house you plan on buying. After you do that, try to figure out what you want to accomplish during that time and make sure that the home will fit those needs. This will allow you to make sure that you will not outgrow your home too quickly.

If a particular neighborhood interests you, take advantage of open houses that come up now and then. This is a good way for you to preview a home at your leisure. You can ask the seller's agent at the open house about the home, nearby schools and the neighborhood, without feeling any pressure.

If you are interested in buying a short sale home, consult an expert. Agents who work in this area can help you identify which homes are going through the process, come up with a fair offering price and structure your offer so it looks appealing to the lender. Hire someone who has represented a fair amount of buyers and has a good record when it comes to closing the deal.

If you are trying to invest in real estate, be prepared to lose some. There will always be other investment properties available. https://www.fool.com/millionacres/real-estate-investing/articles/benefits-and-drawbacks-buying-home-transitional-neighborhood/ should try to keep your emotion out of your buying and selling decisions. When you lose a potential investment property, remember that another one is just around the corner and it could be better than the one you lost.

If there are outdoor power lines in the backyard or very close by to a home that you are looking into, pass up on this home. You do not want there to be thunderstorm or hurricane and have the power lines fall into your yard. https://squareblogs.net/priscilla108reiko/purchasing-real-estate-made-easy-with-tips-that-work can cause a lot of damage and even hurt someone.

If you are looking for ways to come up with a down payment for your first home purchase, you can consider borrowing against your retirement accounts. You can take out up to $10,000, penalty free, from your IRA to use towards your purchase if you are a first-time home buyer.

If you are one of those renters, who likes washing their own cars, check with the rental office to make sure they allow you to do that. Some places even offer a location within the complex where car washing is allowed and the area is designed to handle waste water in an environmentally friendly way.

A buying situation can turn very bad if you let your eyes get bigger that your wallet is. If you do not make enough money to buy that "Dream Home" it is important that you understand that fact and refrain from getting a loan that you cannot afford to pay.

Before you purchase any property, make sure you look long and hard at the windows of the home. Not only the window treatments; someone can easily throw up a flashy curtain. What you're checking for is weather damage, sturdiness, and other structural factors of the windows. They're pricy to replace.

Prior to purchasing any home out there, you always need to check the property thoroughly. Lots of people are too eager to get into the real estate market and end up making bad purchasing which causes them to lose a great deal of time and money. Therefore, before purchasing any property, you must ensure you find out information about the area that surrounds your property, the crime rate in the area, the property's age, and more.

It is important to hire a real estate agent that has good references. If you hire a real estate agent without asking for references, you could end up with someone who is inexperienced or unprofessional. Checking with their references before hiring them is a great way to protect yourself.

Now that you have a better idea of what you should be doing when it comes to buying real estate you're hopefully more confident when thinking about the subject. So remember to apply all that you learned from this article and you should have no problem with buying the kind of real estate you'll be satisfied with.

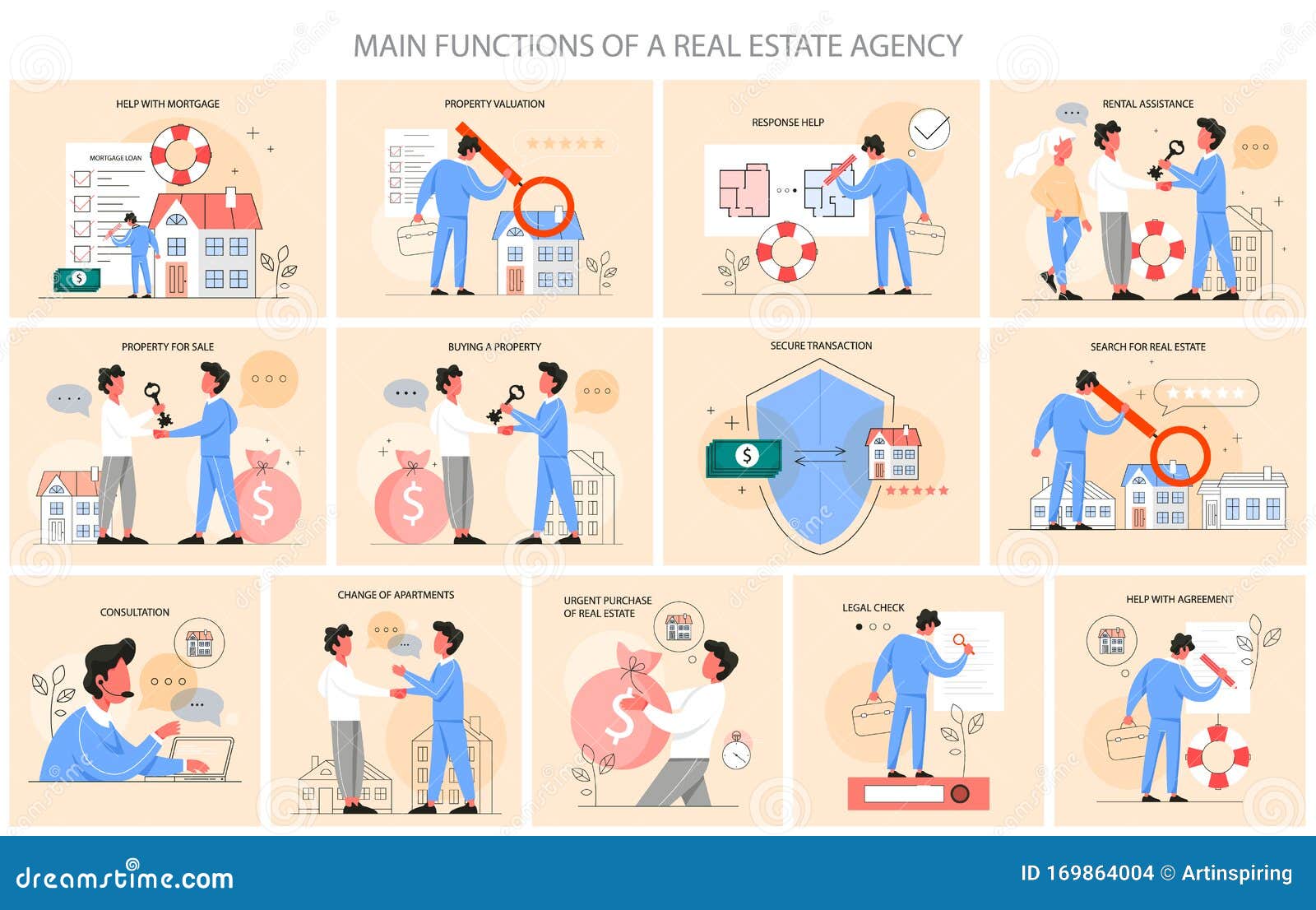

If you have finally found a home that you want to call your own, it's time to go ahead and make an offer. Buying a home is both exciting and scary; there are a lot of various options to consider. Getting help from experienced professionals is a wise move because they can provide some tips and ideas, which will benefit you.

Before looking at homes to buy, take stock of your current financial situation. Look at the level of your current debt, look at the stability of your income, and decide on the amount of house you can afford before you get your heart set on a home that is too expensive for your budget.

Prior to making any offer on a property, be sure to hire an inspector to look over every part of the home. Nothing is quite as disheartening as moving into a home and six months later finding out that the foundation is failing. Check the inspector's credentials, performance history and references before settling on one to inspect your investment.

When you are buying your first home there is an insurance called Private Mortgage Insurance. real estate agent in verrado protects the lender in case you don't make your loan payments. If you can, try to have a down payment of more than twenty percent to: avoid looking like a high risk, and having to carry that insurance.

To help you buy or sell real estate you have to find an agent that you can trust. Checking online reviews and talking to past clients is a great way to find out what others who have experienced working with the him or her have thought about the whole experience.

When buying a home, do not share the agent, inspector, or appraiser with the seller. There is a great chance that you will find yourself in a better position to buy if you find representatives that are on your team to help you get the best price on a home that is worth buying.

If you have a vague idea of how much house you can afford, start saving the money that you would have used for the monthly mortgage, and do not use this money for anything else. This will put the real affordability to the test. It is better to find out now rather than later if you can keep up with the house payments.

Take a look at how long you plan on staying in the house you plan on buying. After you do that, try to figure out what you want to accomplish during that time and make sure that the home will fit those needs. This will allow you to make sure that you will not outgrow your home too quickly.

If a particular neighborhood interests you, take advantage of open houses that come up now and then. This is a good way for you to preview a home at your leisure. You can ask the seller's agent at the open house about the home, nearby schools and the neighborhood, without feeling any pressure.

If you are interested in buying a short sale home, consult an expert. Agents who work in this area can help you identify which homes are going through the process, come up with a fair offering price and structure your offer so it looks appealing to the lender. Hire someone who has represented a fair amount of buyers and has a good record when it comes to closing the deal.

If you are trying to invest in real estate, be prepared to lose some. There will always be other investment properties available. https://www.fool.com/millionacres/real-estate-investing/articles/benefits-and-drawbacks-buying-home-transitional-neighborhood/ should try to keep your emotion out of your buying and selling decisions. When you lose a potential investment property, remember that another one is just around the corner and it could be better than the one you lost.

If there are outdoor power lines in the backyard or very close by to a home that you are looking into, pass up on this home. You do not want there to be thunderstorm or hurricane and have the power lines fall into your yard. https://squareblogs.net/priscilla108reiko/purchasing-real-estate-made-easy-with-tips-that-work can cause a lot of damage and even hurt someone.

If you are looking for ways to come up with a down payment for your first home purchase, you can consider borrowing against your retirement accounts. You can take out up to $10,000, penalty free, from your IRA to use towards your purchase if you are a first-time home buyer.

If you are one of those renters, who likes washing their own cars, check with the rental office to make sure they allow you to do that. Some places even offer a location within the complex where car washing is allowed and the area is designed to handle waste water in an environmentally friendly way.

A buying situation can turn very bad if you let your eyes get bigger that your wallet is. If you do not make enough money to buy that "Dream Home" it is important that you understand that fact and refrain from getting a loan that you cannot afford to pay.

Before you purchase any property, make sure you look long and hard at the windows of the home. Not only the window treatments; someone can easily throw up a flashy curtain. What you're checking for is weather damage, sturdiness, and other structural factors of the windows. They're pricy to replace.

Prior to purchasing any home out there, you always need to check the property thoroughly. Lots of people are too eager to get into the real estate market and end up making bad purchasing which causes them to lose a great deal of time and money. Therefore, before purchasing any property, you must ensure you find out information about the area that surrounds your property, the crime rate in the area, the property's age, and more.

It is important to hire a real estate agent that has good references. If you hire a real estate agent without asking for references, you could end up with someone who is inexperienced or unprofessional. Checking with their references before hiring them is a great way to protect yourself.

Now that you have a better idea of what you should be doing when it comes to buying real estate you're hopefully more confident when thinking about the subject. So remember to apply all that you learned from this article and you should have no problem with buying the kind of real estate you'll be satisfied with.